7 Essential Personal Finance Resources Everyone Should Know

7 Essential Personal Finance Resources Everyone Should Know

Introduction

Managing money doesn’t have to be overwhelming — if you have the right tools at your fingertips. From budgeting apps to free courses, today’s digital world offers resources that can help you save smarter, invest with confidence, and stay on track toward your goals.

In this post, you’ll find 7 essential personal finance resources that are practical, reliable, and easy to start using today.

1. Budgeting Apps

- YNAB (You Need a Budget): Helps you give every dollar a job. Great for proactive planners.

- Mint: A free app that tracks expenses, bills, and budgets all in one place.

- Goodbudget: Envelope-style budgeting for people who want a simple, visual system.

👉 Choose one app that fits your lifestyle and stick with it for at least 90 days.

2. Emergency Fund Tools

- High-Yield Savings Accounts (Ally, Marcus, Discover): Earn more interest on your buffer.

- Money Market Accounts: A safe place for funds you may need quickly.

👉 Pro tip: Separate your emergency fund from your everyday checking account so you’re less tempted to dip into it.

3. Debt Tracking Calculators

- Undebt.it: An online tool to create your debt snowball or avalanche payoff plan.

- Bankrate Calculators: Quick, easy calculators for loans, mortgages, and debt paydown timelines.

4. Free Financial Education Platforms

- Khan Academy – Personal Finance: Free, beginner-friendly lessons on credit, investing, and budgeting.

- Coursera & edX: Offer personal finance and investing courses from top universities.

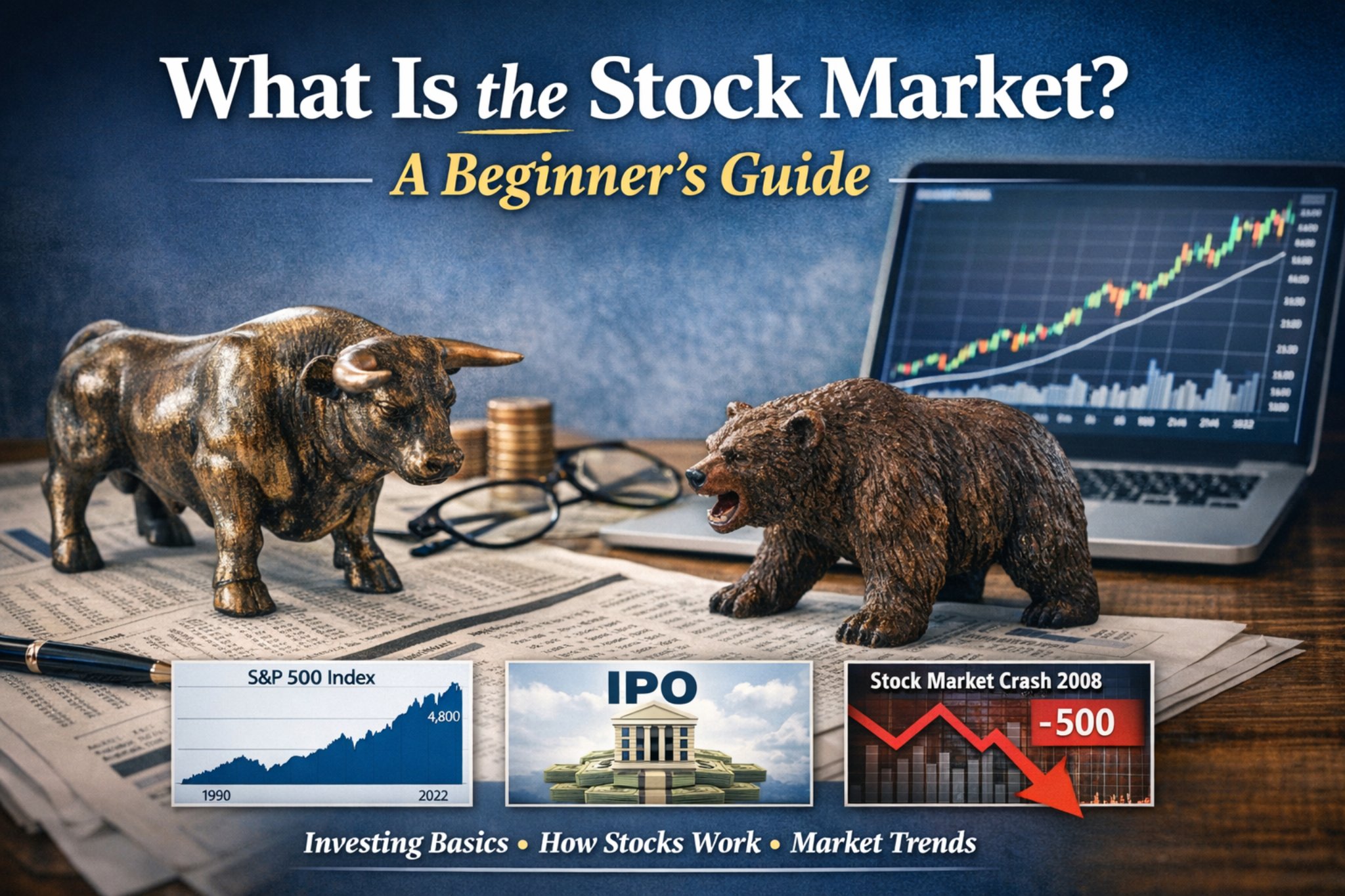

5. Investment Tracking & Learning

- Morningstar: Research on funds, stocks, and ETFs.

- Seeking Alpha (Free + Premium): Market news and community-driven insights.

- Personal Capital (Empower): Tracks net worth, investments, and retirement progress.

6. Community & Support

- Reddit r/personalfinance: Peer advice on real-world money struggles.

- Local Nonprofits & Credit Counseling: Free or low-cost help with budgeting and debt management.

- Podcasts (ChooseFI, Money Guy Show, HerMoney): Learn while you commute or cook.

7. Financial Planning Checklists & Templates

- Monthly budget template (Excel/Google Sheets)

- Debt payoff tracker (color in as you progress)

- Annual financial checkup list (insurance, credit score, savings goals)

👉 Having your plan written down boosts follow-through.

Conclusion

The internet is overflowing with money advice — but not all of it is helpful. By sticking to trusted apps, tools, and communities, you’ll build a system that supports your financial goals in real life.

👉 Question for readers: What’s your favorite money tool or app that’s changed how you manage your finances?

7 Essential Personal Finance Resources Everyone Should Know

Discover the best budgeting apps, debt trackers, investment tools, and free education resources to take control of your money today.

Share this content:

Post Comment

You must be logged in to post a comment.