A Simple Guide to Budgeting Without the Stress

A Simple Guide to Budgeting Without the Stress, Master Your Money:

Take control of your finances with easy budgeting tips that actually work. Learn how to save more, spend smarter, and feel confident with your money.

💬 Why Budgeting Doesn’t Have to Be Boring

Let’s be honest — the word “budget” doesn’t exactly make people jump with excitement. Most of us imagine complicated spreadsheets, strict rules, or giving up all the fun stuff. But here’s the truth: budgeting isn’t about restriction — it’s about freedom.

When you know where your money’s going, you stop worrying about it. You feel in control. You make confident choices. finally see progress. And that’s empowering.

Whether you want to pay off debt, save for a trip, or just stop living paycheck to paycheck, a smart budget is your first step toward financial peace of mind.

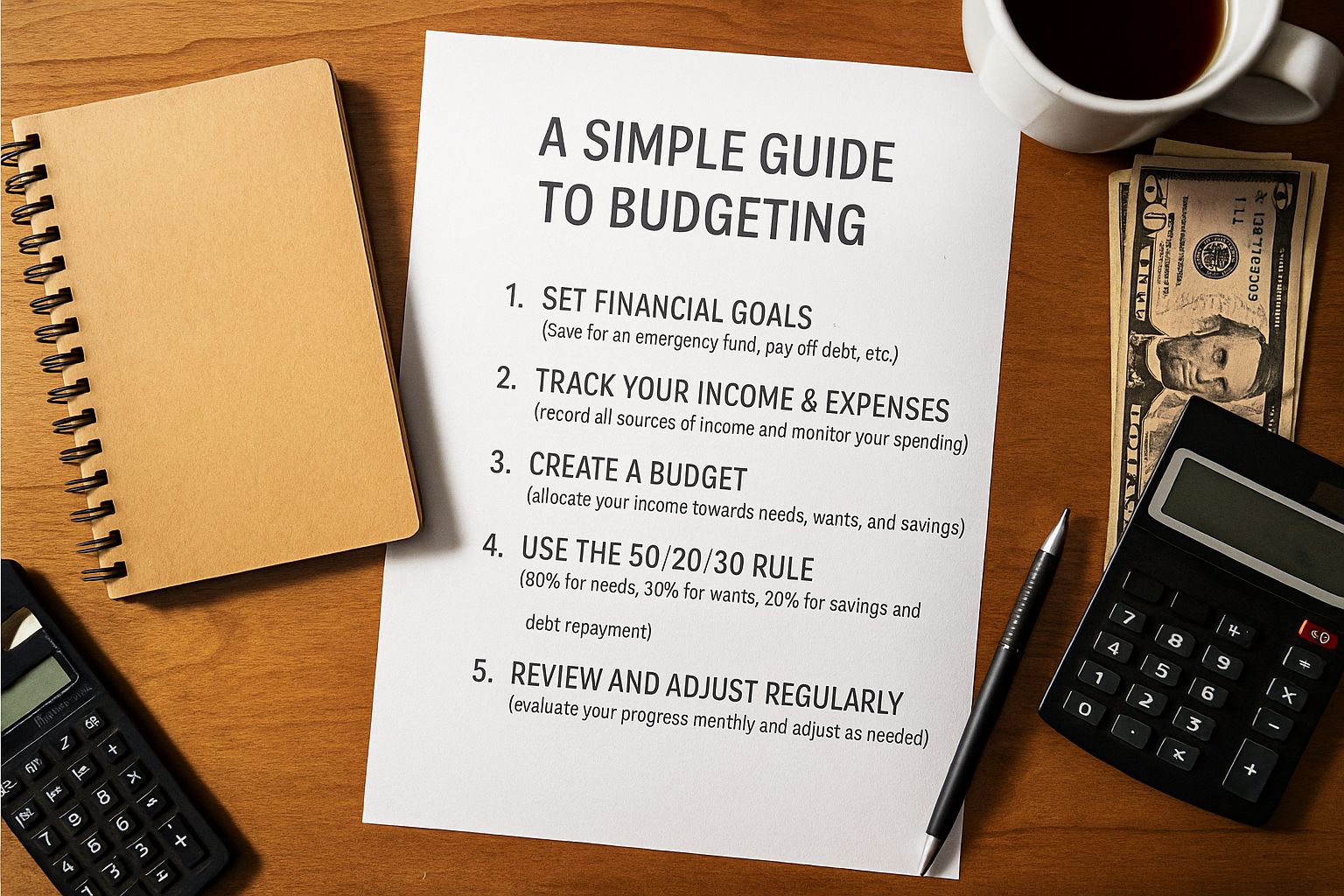

Step 1: Know Where Your Money’s Going

You can’t fix what you can’t see. Before you start planning, track where every dollar goes for one month.

Use an app like Mint, YNAB (You Need A Budget), or simply a spreadsheet or notebook. Write down your income and every expense — from rent to that morning coffee.

After a few weeks, you’ll see patterns:

- How much goes to essentials like rent and food

- How much disappears into subscriptions or impulse buys

- How much (if any) is left to save

This isn’t about judging yourself — it’s about getting honest insight. Think of it as turning the lights on in your financial room.

Step 2: Give Every Dollar a Job

Once you know where your money goes, it’s time to assign purpose to each dollar. This approach, often called “zero-based budgeting,” means you plan how to use every cent — not just what’s left over.

Start by covering the basics:

- Needs – rent, utilities, food, transportation

- Wants – dining out, streaming services, hobbies

- Savings & debt payments – future goals, emergency fund, credit cards

Example:

If you earn $3,000 a month, you might plan:

- $1,500 for needs

- $700 for wants

- $500 for savings/debt

- $300 buffer or personal goals

When every dollar has a purpose, there’s less room for “mystery spending.”

Step 3: Use the 50/30/20 Rule (If You Hate Math)

If you don’t want to crunch numbers every week, the 50/30/20 rule keeps budgeting simple:

- 50% of your income → Needs

- 30% → Wants

- 20% → Savings or debt repayment

This flexible method helps you find balance without obsessing over details. You can adjust the percentages based on your lifestyle — for example, if rent is high, reduce “wants” and focus on savings later.

Step 4: Build an Emergency Fund (Your Safety Net)

Life happens — a car repair, medical bill, or job change can wreck your plans if you’re not prepared. That’s why an emergency fund is non-negotiable.

Start small: aim for $500. Then grow it to 3–6 months of expenses over time.

Keep it in a separate savings account (so you’re not tempted to spend it).

It’s not just money — it’s peace of mind. You’ll sleep better knowing you can handle life’s surprises.

Step 5: Automate Everything You Can

Automation is your best friend.

- Set your bills on auto-pay.

- Schedule automatic transfers to savings.

- Use apps that round up purchases and save the spare change.

The less you rely on willpower, the easier budgeting becomes. Consistency beats perfection every time.

Step 6: Track Progress and Celebrate Wins

A budget isn’t a punishment — it’s a plan for your dreams.

Celebrate every small win:

- Paid off a credit card? 🎉

- Cooked more at home and saved $100? 👏

- Stuck to your plan for a month? 💪

These milestones keep you motivated. Over time, those small wins compound into big results.

Step 7: Review and Adjust Monthly

Your life changes — so should your budget.

Check in at the end of each month:

- What worked?

- What didn’t?

- Where can you improve?

If you overspent, don’t stress. Just learn and tweak your plan. Budgeting isn’t about perfection — it’s about progress.

Bonus: Make Budgeting Fun (Yes, Really!)

Add a little fun to the process:

- Use colorful charts or budgeting apps with visuals

- Turn “no-spend days” into a game

- Reward yourself when you hit goals (within reason!)

Remember: budgeting is a skill, not a talent. You don’t have to be great to start — you just have to start to get great.

Final Thoughts: You’re in Control

Budgeting isn’t just about numbers. It’s about taking back control of your money — and your future.

When you decide where your money goes, you stop letting it control you. You build confidence, freedom, and opportunity.

Start today — even if it’s messy. Track one expense. Set one goal. Open one savings account. Every small step brings you closer to financial peace.

Because at the end of the day, a budget isn’t about limits — it’s about possibility.

A Simple Guide to Budgeting Without the Stress.

Share this content:

1 comment