Beginner’s Guide to Budgeting

Beginner’s Guide to Budgeting: How to Create a Plan You Can Stick To

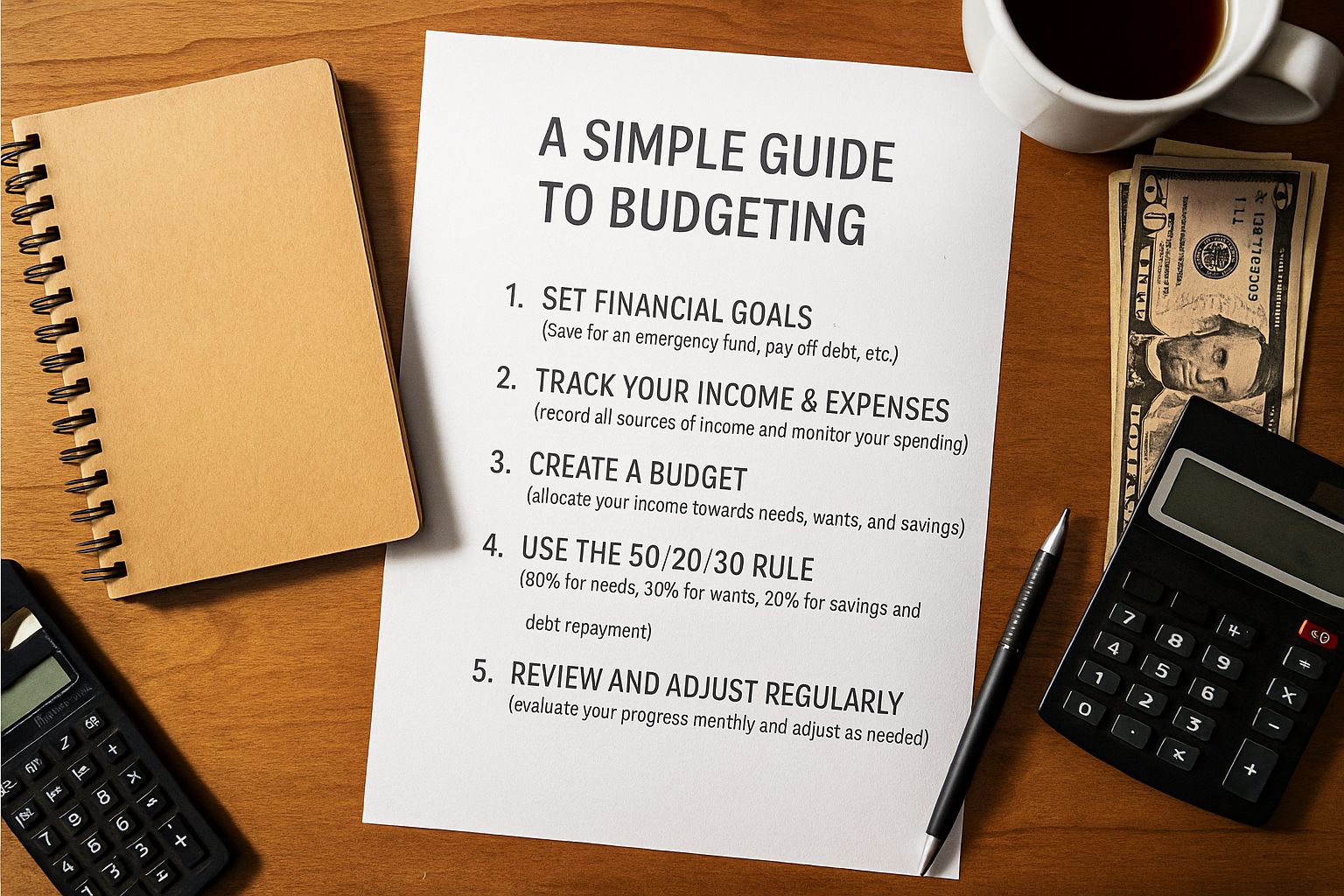

This budgeting guide will teach you how to budget money step by step, with simple rules and tools to help you achieve your financial goals.

If you’ve been looking for a clear and simple budgeting guide, you’ve come to the right place. Learning how to budget money is one of the most important steps you can take to build financial stability. This budgeting guide shows you how to create a personal budget plan that works in real life.

Why Use a Budgeting Guide?

Following a budgeting guide helps you take control of your money, reduce financial stress, and stay prepared for the future. Without a plan, it’s easy to overspend and miss out on savings opportunities.

Step 1: Track Income and Expenses

A key part of any budgeting guide is knowing where your money goes. Write down every source of income and list all expenses. Apps, spreadsheets, or a simple notebook can help.

Step 2: Categorize Spending

Separate your spending into needs, wants, and savings/debt repayment. This makes how to budget money more practical and easier to follow.

Step 3: Apply the 50/30/20 Rule

This budgeting guide recommends starting with the 50/30/20 method:

- 50% Needs

- 30% Wants

- 20% Savings/Debt repayment

Step 4: Stay Consistent

Consistency is everything. Review your budget monthly and adjust as needed. Tools like Mint or YNAB help you stick to your plan.

Conclusion

By following this budgeting guide, you’ll master how to budget money, reduce stress, and reach your goals step by step.

Ready to take control of your money? Download our free budgeting template or explore more resources in our Finance Tools section

Share this content:

Post Comment

You must be logged in to post a comment.