What Is the Stock Market? A Complete Beginner’s Guide

What Is the Stock Market? A Complete Beginner’s Guide

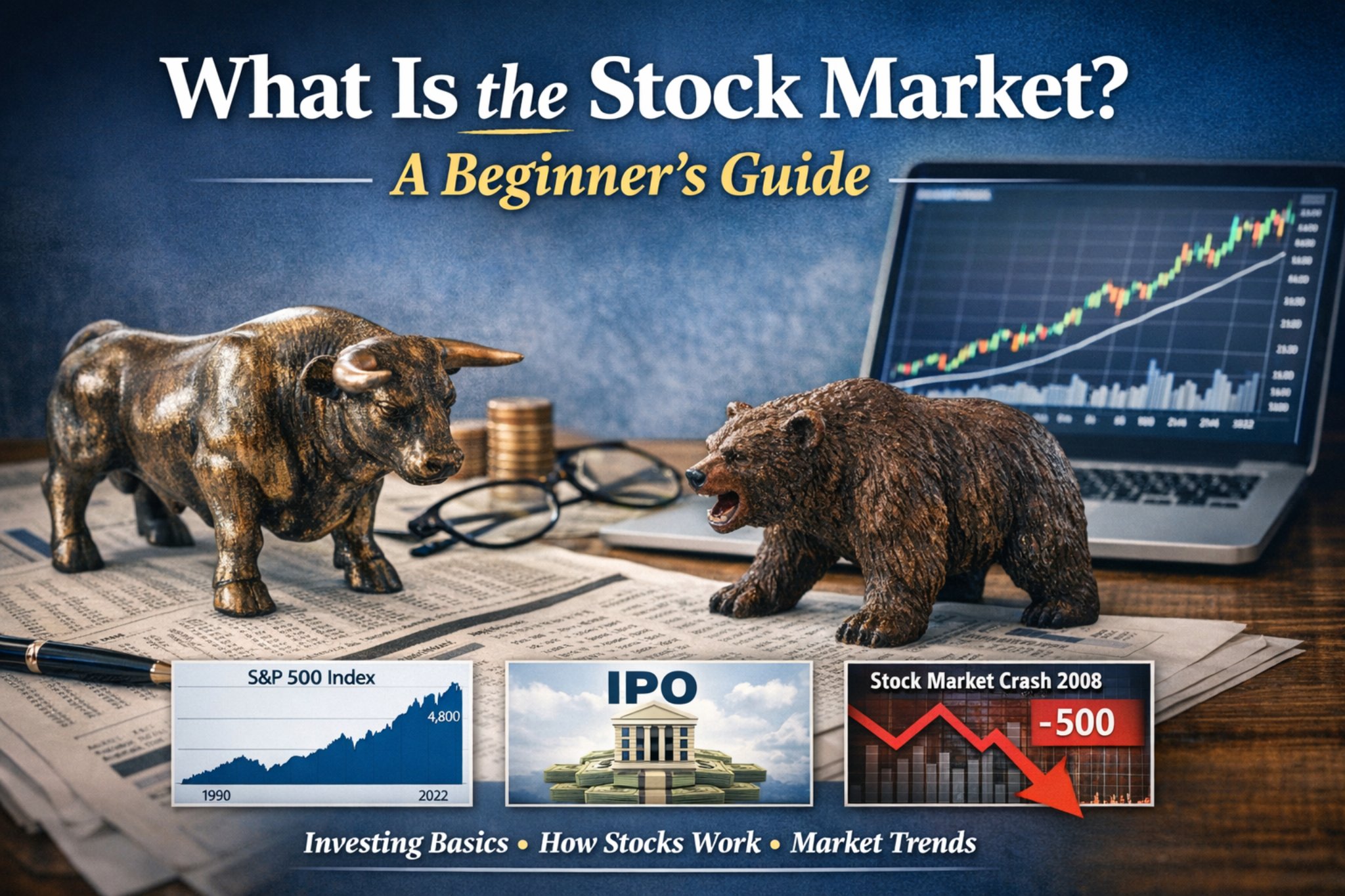

The stock market is one of the most talked-about yet least understood parts of the modern economy. You hear about it on the news when markets “rally” or “crash,” you see headlines about companies going public, and you may even know people who invest in stocks. But what exactly is the stock market, how does it work, and why does it matter so much to everyday life?

In this article, we’ll break down the stock market from the ground up. Whether you’re completely new to investing or just looking to understand the system better, this guide will explain what the stock market is, how it functions, who participates in it, and why it plays such a crucial role in the global economy.

1. What Is the Stock Market?

At its simplest, the stock market is a marketplace where people buy and sell ownership shares of companies. These ownership shares are called stocks (or equities).

When you buy a stock, you are buying a small piece of a company. This means you become a shareholder, or partial owner, of that business. Depending on the type of stock, this ownership may give you certain rights, such as voting on company decisions or receiving a share of the company’s profits.

The stock market brings together:

- Companies that want to raise money

- Investors who want to grow their wealth

It acts as a bridge between businesses that need capital and individuals or institutions willing to provide it.

2. Why Do Companies Sell Stock?

Companies sell stock primarily to raise money, also known as capital.

When a business wants to grow—perhaps by expanding operations, developing new products, hiring employees, or paying off debt—it often needs more money than it currently has. One way to get that money is by issuing stock.

Initial Public Offering (IPO)

When a company sells stock to the public for the first time, it does so through an Initial Public Offering (IPO). This process turns a private company into a public one.

By going public, a company:

- Gains access to large amounts of capital

- Increases visibility and credibility

- Allows early investors and founders to sell some of their shares

In return, the company must follow strict regulations and disclose financial information to the public.

3. Why Do People Buy Stocks?

People buy stocks mainly to make money, but there are different ways this can happen.

1. Capital Appreciation

If a company performs well and grows over time, its stock price usually rises. Investors can then sell their shares at a higher price than they paid, making a profit.

Example:

- You buy a stock at $50

- Later, you sell it at $80

- Your profit is $30 per share

2. Dividends

Some companies distribute part of their profits to shareholders in the form of dividends. These are usually paid quarterly and provide a regular income stream.

Not all companies pay dividends—many prefer to reinvest profits into growth—but dividend-paying stocks are popular among long-term and income-focused investors.

4. How the Stock Market Works

The stock market operates through stock exchanges, which are organized platforms where stocks are traded.

Stock Exchanges

Some of the most well-known stock exchanges include:

- New York Stock Exchange (NYSE)

- NASDAQ

- London Stock Exchange (LSE)

- Tokyo Stock Exchange (TSE)

Each exchange has rules that companies must follow to list their stocks.

Buyers and Sellers

Stock prices are determined by supply and demand:

- If many people want to buy a stock, the price goes up

- If many people want to sell, the price goes down

These trades are executed through brokers, which today are usually online platforms or mobile apps.

5. What Determines Stock Prices?

Stock prices move constantly, and many factors influence them.

Company Performance

Strong earnings, growing revenue, and good management tend to push stock prices higher. Poor results or scandals often cause prices to fall.

Economic Conditions

Interest rates, inflation, employment data, and economic growth all affect the stock market. For example:

- Low interest rates often encourage investing

- High inflation can hurt stock prices

News and Events

Stock prices react quickly to news:

- New product launches

- Mergers and acquisitions

- Government regulations

- Global events and crises

Investor Psychology

Emotions play a big role. Fear and greed can cause prices to swing more than fundamentals alone would justify.

6. Who Participates in the Stock Market?

The stock market includes a wide range of participants.

Individual Investors

These are everyday people investing their personal savings, often through retirement accounts or investment apps.

Institutional Investors

Large organizations such as:

- Pension funds

- Mutual funds

- Hedge funds

- Insurance companies

These institutions control massive amounts of money and can significantly influence market movements.

Traders vs. Investors

- Traders focus on short-term price movements

- Investors focus on long-term growth and fundamentals

Both play important roles in market liquidity and efficiency.

7. Types of Stocks

Not all stocks are the same. They can be categorized in different ways.

Common Stock

This is the most common type. It usually gives shareholders voting rights and the potential for dividends.

Preferred Stock

Preferred stockholders typically receive fixed dividends and have priority over common shareholders if the company is liquidated, but usually lack voting rights.

Growth Stocks

These belong to companies expected to grow faster than the overall market. They often reinvest profits instead of paying dividends.

Value Stocks

These appear undervalued compared to their fundamentals. Investors buy them hoping the market will recognize their true value.

8. Risks of the Stock Market

While the stock market offers opportunities, it also carries risks.

Market Risk

Stock prices can fall due to economic downturns, political instability, or global crises.

Company-Specific Risk

A single company can fail due to poor management, competition, or unexpected events.

Volatility

Markets can be highly volatile in the short term, meaning prices may fluctuate sharply.

Because of these risks, many experts recommend diversification—spreading investments across different companies, industries, and regions.

9. The Role of the Stock Market in the Economy

The stock market is more than just a place to make money; it plays a vital role in the economy.

Capital Formation

It helps businesses raise money to grow and innovate.

Wealth Creation

Over the long term, stock markets have been one of the most effective ways to build wealth.

Economic Indicator

Market performance often reflects investor confidence in the economy’s future.

Job Creation

When companies grow using capital raised from the stock market, they often create more jobs.

10. Long-Term Investing vs. Speculation

One of the biggest misconceptions about the stock market is that it’s a form of gambling. While speculation exists, long-term investing is fundamentally different.

Long-term investors:

- Focus on strong companies

- Hold investments for years or decades

- Benefit from compound growth

Historically, long-term participation in the stock market has outperformed many other forms of saving, despite short-term ups and downs.

11. Getting Started in the Stock Market

For beginners, entering the stock market can feel intimidating, but it doesn’t have to be.

Basic steps include:

- Learning the fundamentals

- Setting clear financial goals

- Choosing a reliable brokerage

- Starting small

- Thinking long term

Many beginners start with index funds or ETFs, which offer instant diversification and lower risk compared to picking individual stocks.

Conclusion

The stock market is a powerful system that connects companies seeking growth with investors seeking opportunity. At its core, it’s about ownership, participation, and shared success. While it involves risk and uncertainty, it has also been one of the greatest engines of economic growth and personal wealth creation in modern history.

Understanding what the stock market is—and how it works—is the first step toward making informed financial decisions. Whether you choose to invest or simply want to be a more informed observer, knowledge of the stock market empowers you to better understand the world’s economy and your place within it.

Share this content:

Post Comment

You must be logged in to post a comment.